The COVID-19 pandemic, a disease caused by the new coronavirus, has slowed markets in many segments around the United States. And with the number of disease cases reaching 1 million, it is natural, after going through the devastating 2008 crisis, that professionals, investors, and clients in the real estate market get concerned about the future.

Is this a bad time to buy and sell? Will property prices fall? Could something like the 2008 crisis happen?

According to ATTOM Data Solutions, the answer is more likely to be no.

What can the past tell us about this?

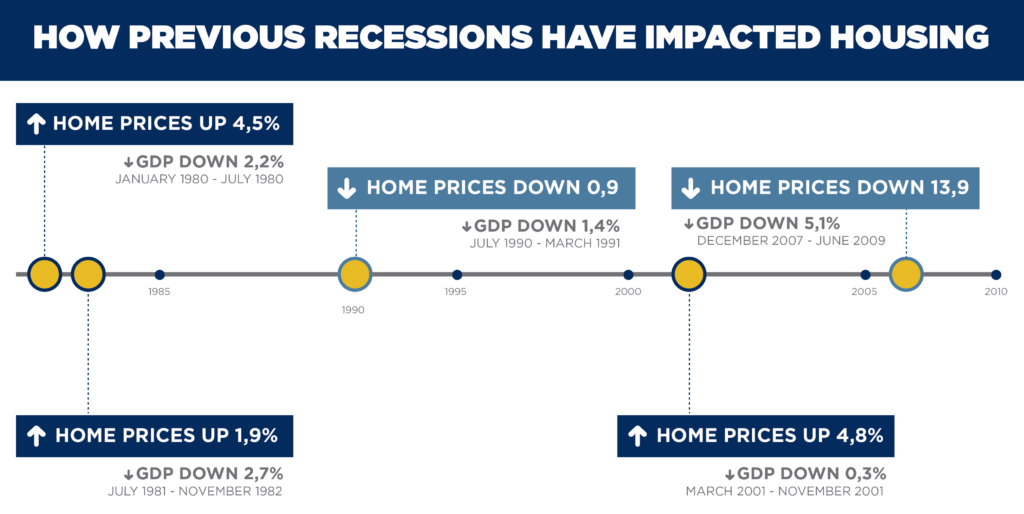

By analyzing the last five recessions in the US economic history, we can see that the price of houses has only come down on two occasions – and in one of them, it went down no more than 0.9%. Check out the infographic below.

This means that an economic recession does not necessarily imply a real estate market crisis. According to Curbed, most real estate professionals do not expect a recession to cause serious damage. Some of them don’t expect any significant effect on the market at all.

The value of homes can increase during a recession

In fact, during the 1980s and 2000s recessions, the average house price went up. In 2008, due to the crash caused by the real estate sector implosion, the average price of fair market rents grew at a steady pace – even with the purchase values deteriorating. [ATTOM Data Solutions]

This happens because housing is an essential asset: even if the economy is going through a delicate moment, people still need a place that provides the necessary stability to continue their lives.

During the ongoing pandemic crisis, it’s easy to see that essential products and services have a higher perceived value than before.

With that in mind, we can expect the real estate market to be sustainable during this delicate period of our lives. So if you need help with buying, selling, or renting properties in Massachusetts, be sure to contact us at Mega.

Our agents are waiting for you.